Turkey cuts rates aggressively to keep credit flowing in crisis

Cnbc is ON AIR - VIEW NOW

Please note: this is Beta feature.

- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

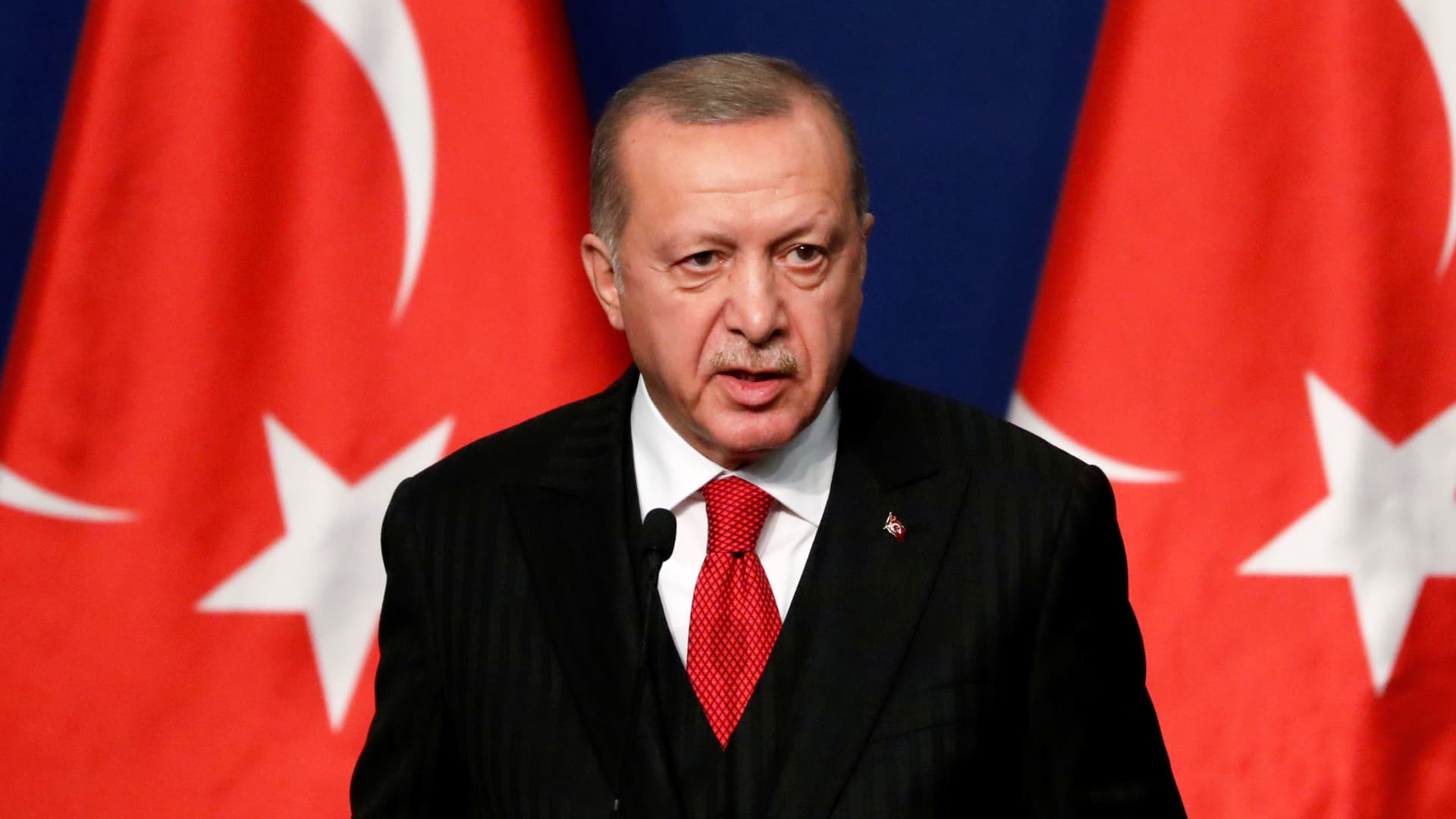

Turkish President Recep Tayyip Erdogan attends a news conference in Budapest, Hungary, November 7, 2019. Bernadett Szabo | Reuters Turkey's central bank cut interest rates to 8.75% on

Wednesday, risking further lira weakness, in a bigger-than-expected move aimed at limiting the economic damage of the coronavirus crisis. While the central bank acknowledged the depreciating

currency, which has tumbled 15% this year, it stressed the need to keep credit flowing and to respond to sliding oil prices as it once again cut interest rates by 100 basis points. Marking

its eighth straight rate cut, Turkey's central bank lowered its benchmark one-week repo rate from 9.75%, extending an aggressive easing cycle that has seen it fall 1,525 basis points in

less than a year, beyond most analyst forecasts. The median expectation was for a cut of 50 basis points in a Reuters poll of 18 economists, with predictions ranging between no change and a

100 basis point cut. The rate cut showed that the bank's "overriding objective is to support economic growth and it is willing to make sacrifices on the Turkish lira, as well as

on financial stability and price stability considerations," said Phoenix Kalen, director of emerging market strategy at Societe Generale. The lira hit its weakest level since August

2018 - at the peak of Turkey's currency crisis - touching 6.999 to the dollar, or around 0.25% weaker on the day. While a weaker lira lifts inflation in import-dependent Turkey, the

currency has outperformed most emerging markets this year. Turkey, the largest economy in the Middle East, is tilting into its second recession in less than two years after a surge in cases

of the coronavirus. Ankara has moved to curb its spread by closing schools, bars and cafes, as well as shutting borders and limiting domestic travel. The bank's policy committee said in

a statement that fallout from the coronavirus outbreak has started to hit trade, tourism and domestic demand so it was "crucial" to ensure markets are functioning and credit is

flowing. Falling global energy prices are lowering inflation expectations in Turkey, which is almost completely dependent on imports to meet its energy needs, it added. Oil prices have

tumbled to near two-decade lows due to the economic fallout from the coronavirus pandemic. The bank added that inflation would probably fall short of its year-end forecast of 8.2%, hinting

at a revision in next week's prices report. 'IN A BIND' Inflation hit a 15-year high above 25% during the 2018 crisis. It has since declined and stood at 11.86% in March, well

above the policy rate, meaning lira depositors face a negative rate of return. Turkish authorities had exhausted room for monetary easing provided by the disinflationary impact from oil,

Kalen said, adding that surveys showed longer-term inflation forecasts were increasing. "Turkey finds itself again in a bind from deeply negative real policy rates, depleted net

reserves, and short-term external debt obligations amounting to $122 billion," she said. The aggressive easing began in July, when President Tayyip Erdogan fired the bank's former

governor for not following instructions, stoking concerns about monetary independence. The Reuters poll showed the policy rate was expected to fall to 8.25% by year end, with forecasts

ranging between 9.75% and 7.75%. The central bank, which also cut rates by 100 points last month, has ramped up a bond-buying program to stimulate the economy, including nearly 27 billion

lira ($3.64 billion) of government debt - most of it from Turkey's unemployment insurance fund - since the end of March.