Argentina 'running out of time' in bond fight

Cnbc is ON AIR - VIEW NOW

Please note: this is Beta feature.

- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

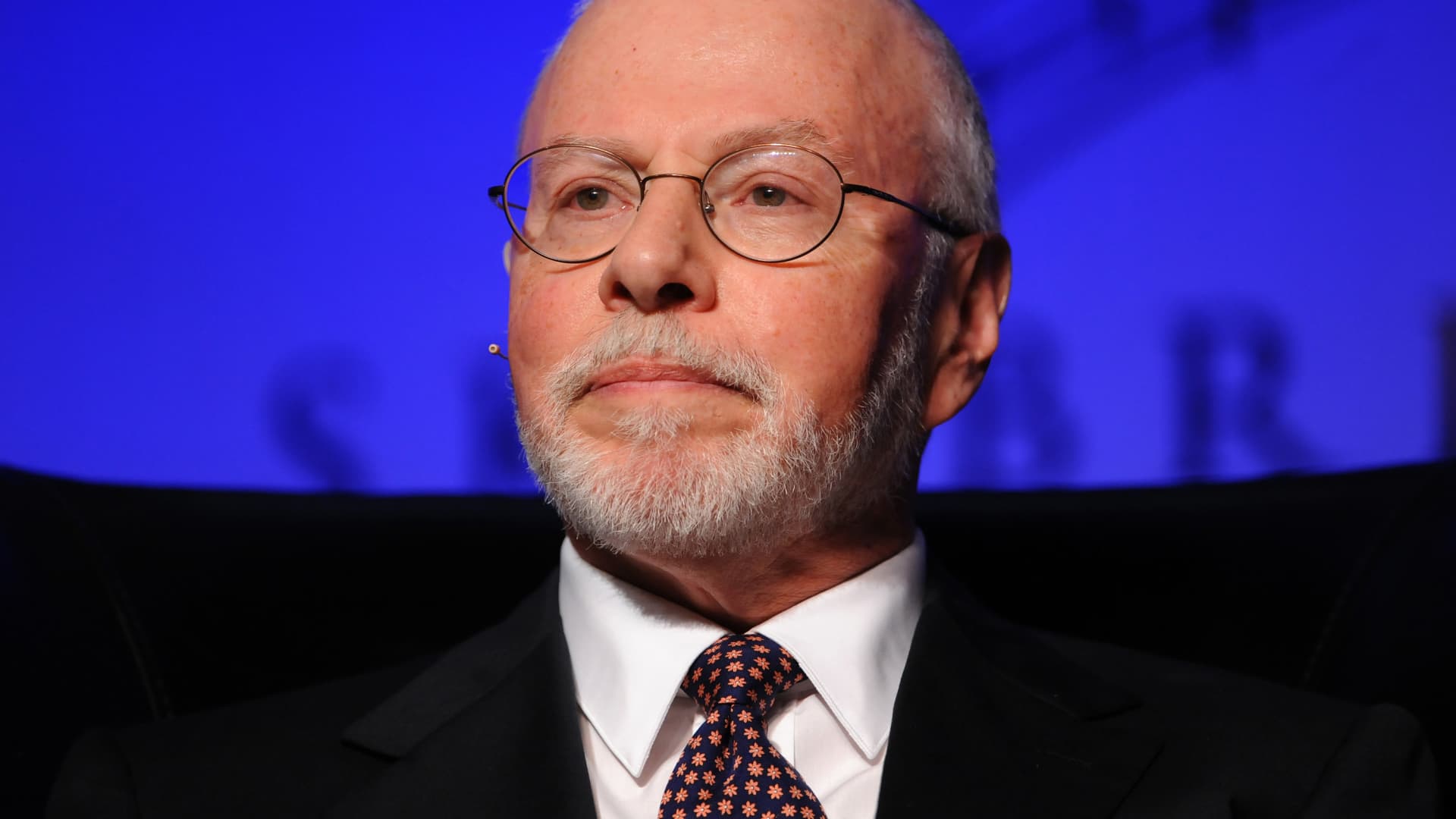

Paul Singer, founder and president of Elliott Management Corp. Jacob Kepler | Bloomberg | Getty Images Hedge fund titan Paul Singer's efforts to resolve his dispute with Argentina over

bond payments isn't over yet. Less than 24 hours after a U.S. judge urged Argentina to pay a group of frustrated foreign bondholders, Singer's Elliott Management signaled it was

prepared to accept a combination of cash and new debt as part of its expected $1.5 billion windfall from its Argentine sovereign debt holdings. But Argentine officials appeared to waver from

plans to negotiate with the hedge fund in person in the U.S., raising questions about whether and when the financial dispute would finally be resolved. Elliott, the $24 billion New York

hedge fund known for its scorched-earth negotiating tactics, is now willing not only to hold talks with Argentine officials, but also to accept newly issued Argentine debt alongside cash as

part of the $1.5 billion in bond payments it is owed, said someone familiar with the matter. Read MoreArgentina says next bond payment 'impossible' The $1.5 billion payment—a big

chunk of the estimated $2.5 billion overall that Argentina owes Elliott for various sovereign bonds the hedge fund company holds—is due no later than July 30, the last day of a month-long

grace period from the current June 30 bond payment deadline. "If they want to talk about a settlement, they can find us," Robert Cohen, one of the attorneys on Elliott's legal

team, said in a hearing Wednesday before U.S. District Court Judge Thomas Griesa. "In six weeks, much bigger deals than this have been (resolved)." During the hearing, Griesa shot

down a plan floated by Argentina's economy minister to change the terms of its existing sovereign bonds as a violation of his prior orders to pay Elliott and certain other bondholders.

"We do not want another charade," Griesa said, referring to the way in which Argentina had shrugged off past legal judgments requiring it to pay the foreign investors.

"Negotiation is fine. But as a judge, what I want is the legal mechanism to prevent another situation where the republic can simply laugh off a judgment." Read MoreArgentine woes

fail to deter EM bond fans Still, during the day or so that followed, Elliott, whose subsidiary unit NML has endured years of litigation with Argentina over its missed debt payments, did not

hear from the South American government's officials, said the person familiar with the matter. In fact, despite assurances from one of Argentina's U.S. lawyers in court on

Wednesday that his client wanted "to have a dialogue" and planned to be in the states the week of June 23 "so that they can negotiate" with Elliott and other creditors

still owed money, an Argentine Cabinet official told reporters in Buenos Aires on Thursday morning that there was "no delegation prepared for a possible trip to the United States."

The Cabinet official's comments were the latest in a string of contradictory remarks from Argentine officials and their U.S. lawyers, casting doubt on the country's intentions of

making a deal. Mark Brodsky, chairman of Aurelius Capital, one of the other firms battling Argentina, said: "It does not matter what Aurelius would accept at next week's settlement

meeting, because we do not believe Argentina has any intention of having that meeting." Read MoreArgentina on the precipice? Maybe, says S&P Despite the conflicting indications on

the Argentina side, many investors, for whom the litigation has become a spectator sport as well as a historic moment in outside bondholders' many battles with the South American

government, were optimistic that settlement talks would occur and that Argentina, which recently settled debts with other foreign investors, would eventually pay. "I think there's

room for negotiation," said Rohit Gadkar, who manages the emerging-market portfolio for the Barcelona-based Trea Capital, which oversees $1.5 billion in assets, including some Argentine

national and provincial debt. A spokesman for Gramercy Funds Management, another hedge fund involved in the situation, declined to comment on whether the firm would take part in any

negotiations. As a holder of restructured bonds, Gramercy was active in the fight—more on the side of the Argentine government to keep payments flowing despite the holdouts' legal

actions. Gramercy sold most of its position in the restructured bonds at a profit earlier this year, according to a person familiar with the situation. The sale was first reported by _The_

_Wall Street Journal_. Argentina wants to access the international capital markets in the future, and given the July 30 deadline, Gadkar noted, it would have to act swiftly. "At the end

of the day, they're running out of time," he said. "This is a country that has really pushed it to the limit." _—By CNBC's Kate Kelly. Lawrence Delevingne and Dawn

Giel contributed to this report._